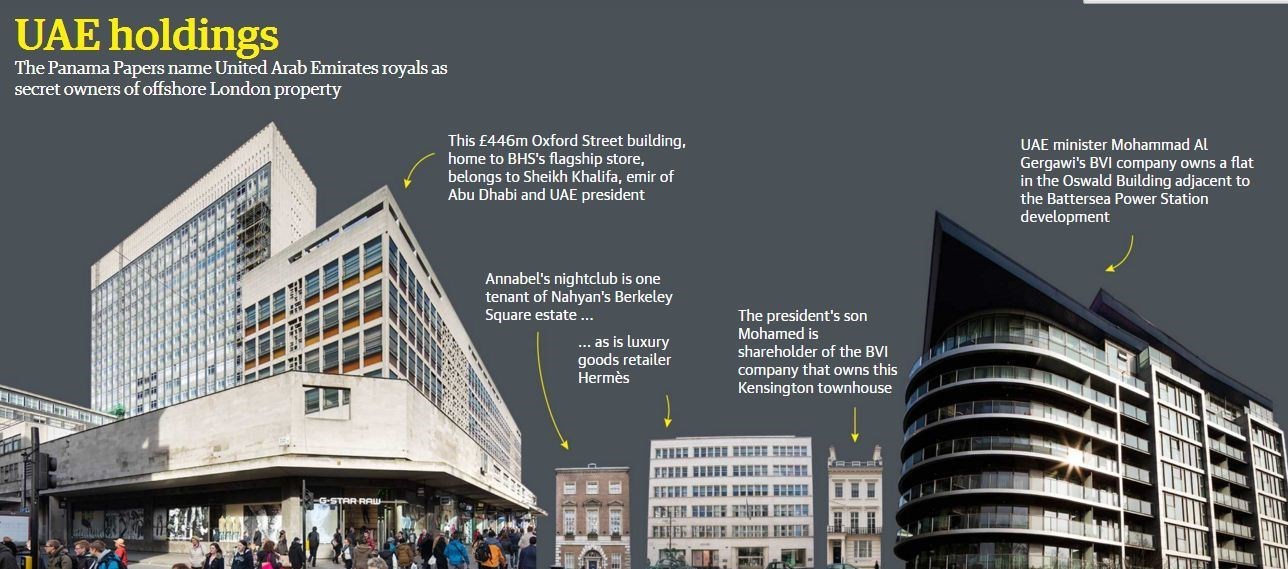

Sheikh Khalifa bin Zayed Al Nahyan owns dozens of central London properties worth more than £1.2bn through offshore companies supplied by Mossack Fonseca.

His property portfolio runs from the BHS building on Oxford Street to the designer outlets of Bruton Street and Mayfair’s Berkeley Square estate, where his tenants include Hermès, Stella McCartney and Annabel’s nightclub.

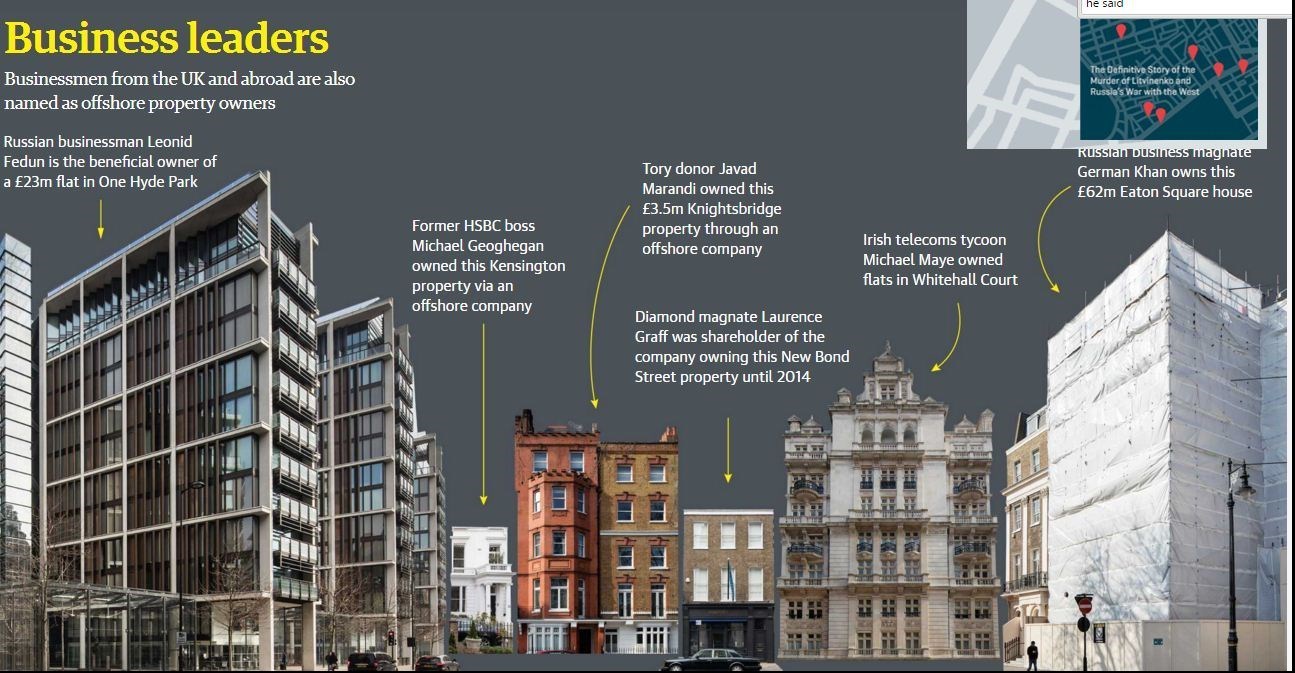

World leaders, business people and celebrities are among those whose anonymous ownership of London property has been exposed by the massive leak of the Panama law firm’s data on offshore companies.

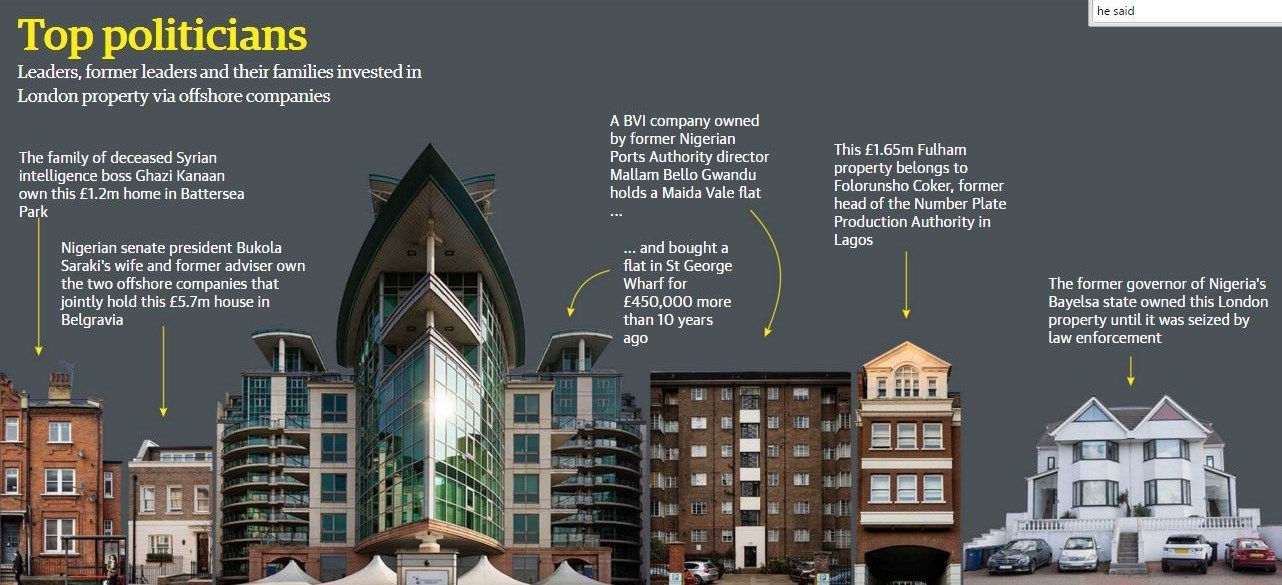

The prime minister of Pakistan, Iraq’s former interim prime minister and the president of the Nigerian senate are among those whose links to London property are detailed by the files.

More than £170bn of UK property is now held overseas. Much of that is in London, where unprecedented house price inflation has transformed homes into highly profitable investments for asset speculators. Nearly one in 10 of the 31,000 tax haven companies that own British property are linked to Mossack Fonseca.

Owning UK property through offshore companies is perfectly legal. However in some parts of the Britain, particularly in London, the use of offshore companies to purchase properties as investment assets rather than homes has helped fuel house price inflation.

Around 2,800 Mossack Fonseca companies appear on a Land Registry list of overseas property owners dating from 2014. The companies are connected to more than 6,000 title deeds worth at least £7bn, although the true value is likely to be greater since many property deeds do not specify the price paid for the property. There is no suggestion of any wrongdoing or unethical behaviour on the part of any of the offshore property owners identified by the files.

It was previously known that the ruling family of the UAE, based in Abu Dhabi, had made inroads into the UK property market.

The president’s father, Zayed bin Sultan Al Nahyan, oversaw the purchase of the Berkeley Square estate of commercial and residential property in the heart of Mayfair in 2005, and two years ago it was reported that the Nahyan family had become the largest Mayfair landowners after the Duke of Westminster.

But the leaked files reveal their property interests extend far beyond this, with a string of commercial units on Sloane Street and a £160m stretch of property along Kensington’s De Vere Gardens, along with other holdings in Marylebone Road, Richmond and Oxford Street.

A 2014 email from Nahyan’s lawyers names him as the beneficial owner of a dozen offshore companies that also appear in the Land Registry’s list of overseas companies that own British property. Ninety title deeds, some of which include dozens of properties, are linked to the Nahyan companies.

In some cases Nahyan’s property owning companies were themselves owned by other offshore companies, which held their assets in trust for the president. His identity was anonymized in all but a few documents. “We do not, as you know, refer to His Highness by name in our work for the companies and do so by exception here, in order to assist you,” Nahyan’s lawyer wrote in one letter.

The president did not respond to repeated requests for comment, the Guardian reported.

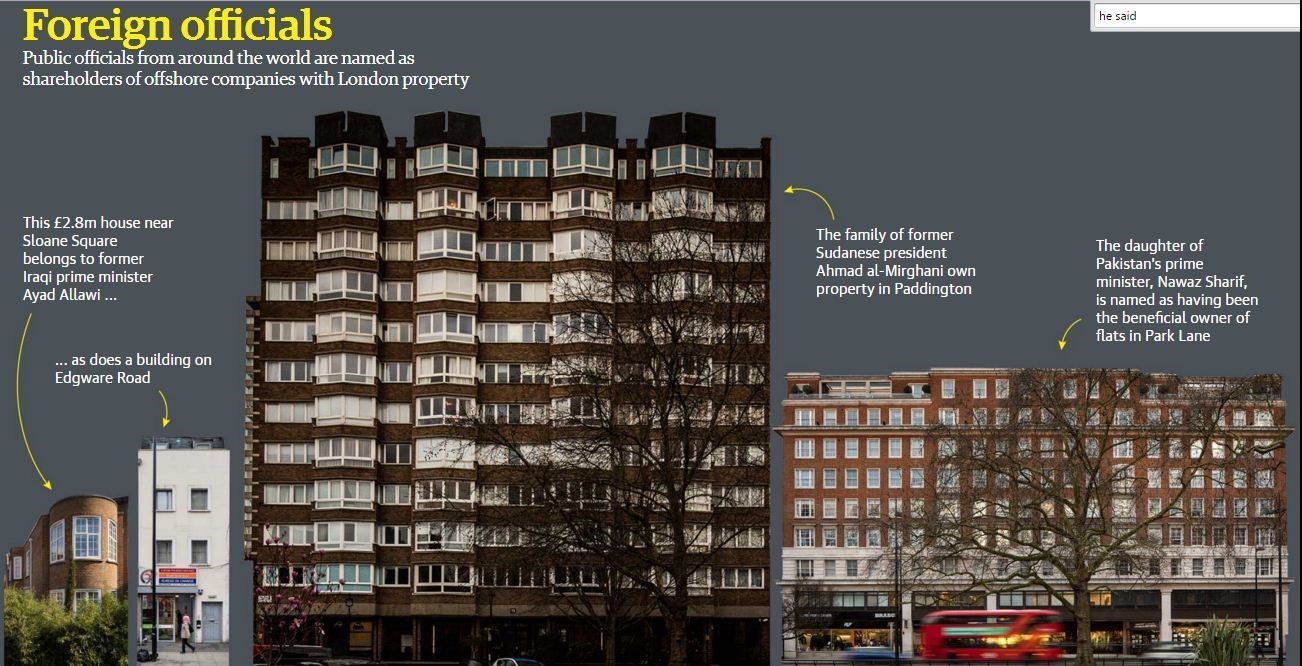

Also named in the files is Mariam Safdar, the married name of the daughter of the Pakistani prime minister, Nawaz Sharif. A 2012 email identifies Safdar, usually known as Mariam Nawaz Sharif, as having been the beneficial owner of two offshore companies that each own flats in Avenfield House on Park Lane.

The Sharif family has previously denied any impropriety in relation to the property, saying they were bought because the Sharif children were studying in London. On Monday the Sharif family issued a statement declaring that Safdar “is not a beneficiary or owner of any of these companies”. Separately Sharif’s son, Hussain, said that the family had done nothing wrong. “It is according to British law and laws of other countries that it is a legal way to avoid unnecessary tax via offshore companies,” he said.

Ayad Allawi, who spent years in exile before becoming Iraq’s prime minister in the wake of his country’s war, is identified as a director of two British Virgin Islands companies that own property.

Foxwood Estates Limited bought a £2.75m Kensington town house in 2008, while one year later Moonlight Estates Limited bought a £750,000 commercial building on Edgware Road. A spokesperson for Allawi told the International Consortium of Investigative Journalists that the companies had been set up based on security and legal advice.

At least 700 properties were owned by companies named in the Panama Papers that were themselves owned through bearer shares – anonymous documents that grant ownership to the person physically holding the certificate. Bearer shares are now in effect banned in many countries, including the UK, due to their attractiveness to criminals.

An offshore company connected to David Hunt, reported in 2011 by the Sunday Times to be a gangster, is also named in the files. EMM Limited used to own an industrial property in east London at which Hunt ran an iron and steel business.

Mossack Fonseca appears to still act for Hunt’s company, despite a high-profile libel case in which the high court threw out Hunt’s defamation suit against the Sunday Times. The files also contain a 2008 letter from Hunt in which he admitted there was “missing documentation” relating to the affairs of the company, including accounting records.

Hunt’s lawyer said that EMM was an “off-the-shelf” company bought in 1997 to own the property as a result of advice from a Jersey accountant that he subsequently discovered to be wrong. “In 2006 … Mr Hunt entered into an agreement with HMRC under which he provided full disclosure of his affairs, including in relation to EMM Limited, and settled all his tax liabilities,” he added.

Bukola Saraki, the president of the Nigerian senate who is currently facing allegations that he failed to declare his assets, owns a property in Belgravia in his own name. The Panama Papers reveal the £5.7m property next door to be owned by companies incorporated in the Seychelles and BVI, whose respective shareholders are Saraki’s wife and former special assistant. Saraki told the Guardian he had declared all his assets correctly and in accordance with Nigerian legislation.

In another instance, a £1.65m townhouse in Kensington and Chelsea is shown as belonging to a BVI company whose sole shareholder is Folorunsho Coker, the former head of the number plate production authority of the state of Lagos and currently business adviser to the governor of Lagos. Coker’s lawyer said he had multiple sources of income and had always declared his interest in Satori Holdings to the Nigerian authorities.

Offshore companies and trusts can also enable investors to keep assets hidden while potentially reducing capital gains and inheritance tax or stamp duty in a manner not available to ordinary homeowners.

Transparency campaigners have warned the secrecy of such arrangements can enable large sums of black money to be laundered through the property market. A senior National Crime Agency director warned last year that the capital’s housing market had been “skewed by laundered money”.

The British government recently launched a consultation into whether to force offshore property owners to disclose their identities after David Cameron expressed concern that UK properties “are being bought by people overseas through anonymous shell companies, some with plundered or laundered cash”.